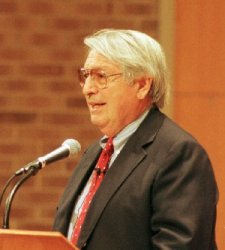

Speaker Name: Stanley K. Tanger

Speaker Title: Founder, Chairman and CEO

Speaker Company: Tanger Factory Outlet Centers, Inc.

Tanger Factory Outlet Centers, Inc. Website

It's a privilege for me to be here at the John A. Walker College of Business at Appalachian State University. Thank you very much Chancellor Borkowski and Dean Peacock for inviting us here today. It's a great pleasure and an honor.

It's a privilege for me to be here at the John A. Walker College of Business at Appalachian State University. Thank you very much Chancellor Borkowski and Dean Peacock for inviting us here today. It's a great pleasure and an honor.

I'd like to also introduce to you my wife, Doris Tanger, who made sure that I got here on time today and wore the right shirt and tie.

Have any of you been to a Tanger Outlet Shopping Center? That's great, wonderful. The manager of our shopping center in Blowing Rock is also here -- Ms. Susan Tomlinson. If you have any problems or complaints or need a good deal, mention my name to Susan and she will take care of you.

In North Carolina we also have another shopping center located in Nags Head. Our company is a public company; we're traded on the New York Stock Exchange. Merrill Lynch took us public in 1993 and they were looking for a symbol for out company. I guess all of you know that there's a three-letter symbol for New York Stock Exchange companies and four letters for NASDAQ companies. They were looking for a symbol to use and, naturally, I came up with a symbol, SKT, my initials. So if you want to know more about our company, not only are we on the internet but also our symbol is SKT.

We had our first meeting here at Appalachian State University with Professor Jim Stoddard and Professor Unal Boya in your Marketing Department. We had offered a challenge to them to see how we could get more students from Appalachian to come shop at our shopping center. At that point, we set up a scholarship program which began in 1999 and which we hope to continue every year. The first four students to receive Tanger scholarships were Katie Pollock, Susan Branch, Amanda Marshall and Blair Adderly. You have a wonderful university; I've heard so much about it today. Since we're neighbors, we've got to get together and do more things together.

I want you to know a little about our company. Our mission statement is very simple. First and foremost, hire great people. That's important in any company. Hire great people and, most importantly, empower them to do their job and then get out of their way. They'll run you over if they're good. If they're no good, they're going to be running the wrong way. So hire good people and get out of their way and let them do their job.

The next part of our mission statement is to understand your customers' needs. It is extremely important that you know what your customers need and what your customers want. You can't select things for them if they don't want them, and they won't come to your shopping centers unless you have the right things there. So understand your customers' needs and work together to satisfy them.

The next important part is to focus on solutions, not on problems. For all of you young people here today, there are lots of problems out in the world, but if we focus on them and spend too much time on them, we'll never find the solutions. So, it's extremely important to focus on the solutions. Follow through and do what you say you're going to do. All of our staff have that same idea to follow through and do what say you're going to do. Please, when you make a promise, to it, even though it hurts sometimes, just do it and make sure it happens.

The last part of our mission statement is also an important one -- have fun and play to win. It's very, very important. If you have a job but you're not having any fun in it, get out of it and go somewhere else. We believe that you've got to have fun and you've got to play to win.

At this point, I'd like to tell you how Tanger Factory Outlet Centers started and why the business has become such a great success. I was in the shirt business for many, many years manufacturing private label shirts in a place called Reidsville, North Carolina. We manufactured shirts for Bloomingdale's, Saks Fifth Avenue and all the better stores throughout the country. Every once in a while the stores would find that they were totally overstocked. Is anybody here an accountant? The store gets overstocked, they run out of their budget, the budget gets all messed up and they've got to do something about it. So, of course, they would call their buddy Stanley Tanger with a plea to, "Help me out, take back about $50,000 worth of shirts in the original containers and after a month I will take them back. Trust me."

When someone says, "trust me," be very careful, because after thirty days, Charlie the buyer, with whom I worked and trusted, might be gone. Bill, the new buyer, would say, "Stan, I don't choose your product, I don't choose your brand. Those are your shirts and it's up to you to keep them." So, what was I going to do, there was no way of taking the labels out of the shirts. If I sewed a label, it was going to go right through the back of the shirt and destroy it.

So, at our shirt factory we always had a factory store where surplus merchandise, mismatches, and other type merchandise was sold to the public. When I put Saks Fifth Avenue shorts or Bloomingdale's or Marshal Fields or Neiman Marcus shirts in an outlet store, as retailers say, they "blew out." They really sold and I was making a lot of money. It was a good deal, until Saks Fifth Avenue's lawyers called me and said, "Hey, you've got to stop selling the shirts with those labels." I said, "What am I going to do? They're your shirts, I made them especially for you and I've got to dispose of them somehow."

Are there any bankers here? Well, the bank was after me, they wanted to get their money for those shirts. So what we did was to stamp the word "irregular" on the label and that's the secret I had to tell you. The minute I stamped irregular on the label, the shirts became more valuable. The consumer thought, my goodness, I'm going to beat the system. Maybe there's something wrong with the shirt, but at a price, I'll buy it.

This is really how we started. The shirts sold very well and, in 1979, I decided to sell our company. Interest rates were at 19 and 20 percent, if you bankers can remember; I think you students are probably too young to remember that. But it can happen again. Rates had gone up. I decided to sell the company and to retire.

That was probably one of the worst things I ever did -- retire -- because I flunked. My advice is to not ever retire. If you retire, retire to something. My wife said "You know I married you for better and for worse, but I didn't marry you for lunch." I said, "Don't you worry now, on Monday morning I'm going to get out and get a job." Well, on Monday morning, nobody wanted to know me. I was no longer the president and CEO of a going business. I was the guy without a job. I was a retiree.

I spent a couple of weeks trying to figure out what I was going to do when I got older and I had a great idea. Why don't I build a shopping center with national tenants that will sell through a national outlet at a location I found in Burlington, North Carolina? I guess some of you know where that is. It's on I-85 between those other schools in Raleigh-Durham-Chapel Hill and those schools in Winston-Salem.

I went to a number of banks because I learned a long time ago that it's easier to spend somebody else's money than your own. You students probably know that by now. We've got some very good banks here in North Carolina that we can be very proud of. And at each bank I went to, whether it was NationsBank which is now Bank of America, Wachovia, BB&T, or First Union, each one of them started to grill me about what kind of experience I had. I had no experience in the real estate business and I was going to be a developer. Interest rates, as I said, were up at 19 and 20 percent. I had never built a thing in my life. I had no idea of the difference between a 2x4 and toilet flushing equipment. I had no idea what it was, but I wanted to build a shopping center.

Each of the bankers asked me how old I was. That was a tough question because I was 58 years old. That's pretty old. Each one of the bankers said, "Hey, why don't you go and retire? This is not the kind of business for you to get into. You'll never make it because nobody will come to Burlington, North Carolina." Yet I still had this idea that I could bring wonderful, national tenants to North Carolina.

One day (and this is a true story) I had used up all my ideas with the banks and I stopped at a gas station next to a little bank, called CCB. I walked in and the lady asked if she could help me. I told her that I wanted to borrow some money and she said that was what they did there and she asked how much I needed. I said, "Well, about $10 million." That stopped her right away. She took me to meet the bank manager and we went through the whole story. I told him exactly what I was going to do; I was going to bring national Fortune 500 tenants to Burlington, North Carolina. That was quite a feat in those days.

Instead of turning me down (and this was a very creative banker and that's another thing I want to see in people -- creativity) he said if I would bring the leases for those Fortune 500 tenants, he would loan me 70 percent of the value of the lease. Now that was a great idea, but I had no real leases yet, only the idea. I started making calls to friends of mine who were in the garment business. The first one I was able to bring down to North Carolina was a company called Ship 'n Shore, which is out of business now. They sent a representative to see my shopping center. I said I don't have a center yet, I've just got an idea and I've got a great location right here on the interstate, and I will build a shopping center.

He got very upset with me and went back to Philadelphia. I called his boss (and this is a true story), and told him that there was some misunderstanding and that I'd like to come to see him. This is another idea that you young people should know -- get on an airplane or a train or a bus or something and get eye-to-eye with someone. One-on-one is the way to do it. I had learned a long time ago in the shirt business to ask for the order. That was the way we did things. Before I went up there I told myself I'd better get a lease, I'd better get an exhibit and I'd better get something else that I could show somebody, because just to go to Philadelphia and spend a lot of money on a plane ride made no sense.

I found a young lawyer in Burlington, North Carolina (who incidentally is still working with me) and I asked him to get together a lease and, of course, I said to make it in my favor, let's start out with a lease that is a developer's lease. He did and also told me that I would need some exhibits. You people in marketing know about exhibits, which meant I had to get an architect to make a drawing for me with an elevation and that became our exhibit.

I went to Philadelphia and met with the Ship 'n Shore people. We sat down and talked about the store and they liked the idea. We finally came up with a price and they said "Can you be open by July?" This was in February, so I said, "Of course, no problem at all." Little did I realize that building a building takes a lot of time. It's not quite that easy. And February in North Carolina can sometimes be very brutal.

I pulled my lease out of my briefcase and handed it to them. The first thing they did was tear up the lease. I said, "That lease cost me $150, what are you guys doing?" They told me I had to learn the golden rule if I was going to be in this business. I said, "Well I try to practice that all the time." They said, "No, the golden rule is, who's got the gold makes the rules." I had never heard that one. So they set their own lease and that's how we got started with business. I thought that if I could lease 15,000 square feet, that would keep me out of the house and keep my wife away from me and wouldn't affect her bridge games.

The first year we leased 15,000 square feet. It worked out very well. In three years, with a secretary and myself, we built 300,000 square feet. A pretty good feat when I didn't know what the devil I was doing and with interest rates up to 19 and 20 percent.

However, I made a very, very strategic error that I'll share with you today. My idea was to have national Fortune 500 tenants but I didn't realize they had to be manufacturers. The tenants I had were good: Burlington Coat, Linens & Things, Dress Barn; good fine credit tenants. I never had to worry about the credit. But, there was no loyalty on their part. They also opened up in Greensboro and then they opened up in Raleigh-Durham. There was really no reason for the consumer to come to Burlington to buy what I thought was going to be directly from the manufacturers.

A company came to me sometime in 1984 or 1985 and said they wanted to buy my company. Now, that's always a good sign if someone wants to buy your company -- figure out an exit plan. They kept offering me prices. On the other hand, I really enjoyed being in this business because I was making a few dollars. I no longer had the problem of marking down shirts. I drove my own car and I wore a shirt and tie to work. I had a nice little business going. At any rate, they kept on my case continually. Every time they called me, they kept raising the price.

That's a very good negotiating practice. First say no and then they'll raise the price. It got to the point where the price was out of sight and we did sell the property to them. At the closing table, I said, "You know, you guys overpaid me." They said, "We know we overpaid you but we're going to convert this property." Those were the days back in '84-'85 when they were building these two-for-one limited partnerships. The bankers and lawyers can probably remember those days when you'd put $2 down and get $4 worth of deductions, depreciation, and all kinds of things. The tax was going to be changed in 1986. It did change and I got rid of the shopping center at the right time.

I still learned a good lesson -- I had to have national Fortune 500 manufacturers, someone who manufactured the product and sold it directly to the consumer. That made the big difference. The Dress Barns and the Burlington Coats and Lines & Things bought products from all different kinds of manufacturers and really didn't sell one particular brand.

Over the years, I had decided that with these national manufacturers, Liz Claiborne should be my key manufacturer. I set a goal and that's another good lesson for you young people. I set a goal that I would get Liz Claiborne to open up a store. Do you know the Liz Claiborne company? In fact, we just opened up a Liz Claiborne store in Blowing Rock. I kept driving Liz Claiborne's secretary crazy. One day her secretary called and said, "Mr. Tanger, can you be in New York tomorrow?" I said, "I'll be in New York tomorrow." She said, "You're having lunch with Liz Claiborne." We had lunch in a beautiful dining room, and once we got through the small talk, Liz Claiborne wanted to know why I was there. I said, "Well, I'm going to develop an outlet center and I want a Liz Claiborne outlet store." She became very indignant and said she wouldn't do outlet stores and that was the end of the meeting. She got up and walked out.

But her husband was with us and thought we had a great idea. Let me start the whole story over again. In every one of our shopping centers we have a Liz Claiborne outlet store. The lesson to be learned was to have a lead tenant, an anchor tenant.

Another thing that we learned in the business was to never build on speculation. Do we have any developers here? It's a hard lesson to learn. But our discipline is that if we don't have at least 75 percent of the leases we want to have and the national tenant, then we take down the option and build the shopping center. That's what our philosophy has been all the years we've been in business and that's been about 20 years.

I had a call about six months ago. I've got a secretary who is kind of like a drill sergeant; she protects me, or thinks she does, from crazy calls. One day she said there was a man on the phone that I ought to talk to. He said his name was Warren Buffet. I answered the phone and this man introduced himself as Warren Buffet. He said he loved my company and that he had purchased a lot of the company's stock. In fact, he said he had bought quite a bit of stock and that he was filing a form 13G with the SEC letting the world know that he is a passive investor. He said the next time I was in Omaha, to come on out and have lunch.

I thought this guy was joking about the next time I was in Omaha (I don't get to Omaha very often). A few months later I called him, told him who I was and said that I wanted to come out and visit with him. He suggested the next day and I agreed. I made the trip to Omaha and had lunch and spent the day with a very delightful man. He drives his own old Lincoln Town Car.

In making conversation I asked him if he had a computer. I said I had heard he doesn't believe in tech stocks and things like that. He asked me if I knew Bill Gates. I said I didn't think so. He told me Bill Gates had shipped him a computer. I asked him what kind he had. He said he didn't know. Of course, my next question was what do you do with it if you don't know what it is. He said that he played bridge on it. He said it cost him $9 a month to play bridge and there's a bridge program called OK Bridge where everybody uses a code name, so if you play bridge with someone by the name of T-bone, that's Warren Buffet.

It was interesting going on the New York Stock Exchange. In the early '90s, the banks were very tough on loaning money. A lot of banks had gone out of business; some of the S&Ls had major problems. The control of the currency had decided that the valuations of some of the properties were a little high and they had reduced them. So this made for a very big problem getting capital. About that time, I was using ten different banks because I never believed in having one banker run my entire destiny. In every town I went into, I'd call the bank--you know it's much easier to get hold of the president of the bank than a loan officer. In fact, the loan officer usually says no before he answers the phone. The president of the bank says, "Come on over." And I did go over and I worked with the different banks and McColl became a friend of mine, as did several other bankers.

It was getting tougher and tougher with interest rates going up, so I decided to call Merrill Lynch and some of the other banking firms and see about becoming a public company. I'm persistent sometimes. When I finally got the president of Merrill Lynch and his first answer was, "We haven't done any factory outlet shopping centers yet and real estate is not going too good on the New York Stock Exchange. But come on over and let's talk about it."

Well that was a great invitation and the next day I sat down and met with these people and, to make a long story short, six months later we started trading on the New York Stock Exchange. It's quite an honor to see your initials go across the big tape.

Over 62 million visitors come to the Tanger Outlet Centers and the reason I keep saying Tanger is not because it's my name, but because it's our brand name also. We have shopping centers in Oregon, California, Minnesota, Michigan -- 23 states in all. We're all over the country and you can see the Tanger name as you drive down the highway. Also, I know that the internet has become very important to all of you young and old people alike. I know a lot of you young people probably have internet companies that you're running now and have made a lot of money with them. If you haven't, there are a lot of good opportunities out there today. I was reading a great article in USA Today about the number of young people who've started their own internet companies and they've invited some of the faculty to work with them in setting up these companies. They've got a lot of money; I don't know how things are going to be this next week or so or over the next six months in getting funds. It may be a little more difficult.

From time to time we use focus groups to find out how we're doing and what we're doing. Normally we'll hire an advertising company, and they'll bring in anywhere from five to ten people and ask them questions like "have you ever heard of Tanger?" and "Do you know what they do?" and all that kind of thing.

We decided about a month ago, instead of a focus group, to send out a mailing on the internet. We have about 50,000 internet addresses from people who have been to our shopping centers. It's very cheap to send out a mailing on the internet. Everybody seems to be online today and an e-mail doesn't cost anything from what they keep telling me. We sent out thousands of e-mails and we got back thousands of responses -- very good ones. People told us what they like about our company and what they don't like about our company. We found that this was a big help for us.

Here's another point I'd like to share with you. You may have dreamed of having your own company and being a big CEO, driving a nice car and having a big private office. I think you'll find in many cases that a private office is a deterrent for you. You've got to get out with your people, with your staff. I find it's very important to get out into the field and meet the people who run our shopping centers and meet our customers. They really are the people who pay the salaries. As you get bigger and better, you need to get out in the world, forget the big office, just get out and meet and work with your people.