An article by Dr. David Marlett, IIANC Distinguished Professor of Insurance in the Department of Finance, Banking and Insurance and managing director of Appalachian State University's Brantley Risk and Insurance Center, entitled The Perfect Storm in Home Insurance, was recently published by Econofact.

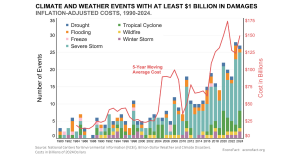

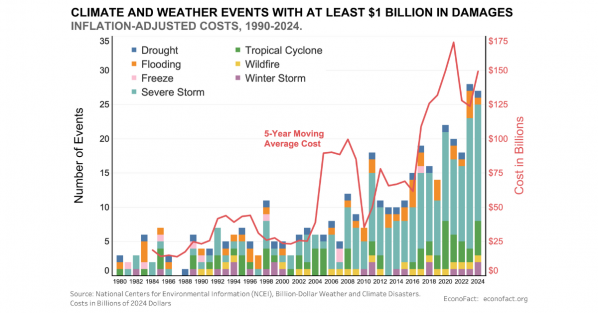

The Los Angeles fires, perhaps the costliest weather-related event in U.S. history, started just a few months after Hurricane Helene which ranked among the top 10 costliest hurricanes to batter the United States. And while hurricanes and wildfires command the most attention, severe convective storms — those traditional hailstorms that generate tornadoes and severe winds — have become more frequent and more severe and are depleting the financial resources of insurers and reinsurers for the so-called normal events. Add to that high inflation and supply chain problems making it more expensive to rebuild and replace property — among other notable factors — and the result is an insurance system that is being stressed in ways it had not been before, essentially breaking down in a number of states...

...In the short term, the outlook for insurance is difficult. Although inflation has decreased from its post-pandemic highs, prospects point to likely increasing homebuilding costs. The construction sector already faces labor challenges and these are likely to get worse with deportation of undocumented immigrants. If tariffs raise prices in the housing sector, this will also contribute to higher insurance costs and rising premiums. Over a longer horizon, through mitigation and wiser development — changing the way we build houses and where we build them — there is a path for improvement. If we can find ways to build homes that are more resistant to damages and able to recover and not be unusable after an event, then eventually we will have a stronger housing stock. But it will require more active government involvement in mandating certain building codes and better informed consumers demanding certain types of construction when they buy a house.

Read the complete article online, https://econofact.org/the-perfect-storm-in-home-insurance.

About the Brantley Risk and Insurance Center

The Brantley Risk and Insurance Center in Appalachian State University's Walker College of Business enhances the academic experience by providing space and staff to assist risk management and insurance majors with networking, job placement preparation and contact with faculty members outside the classroom. It provides students opportunities to participate in professional designation and licensing programs, and invites industry leaders to participate in classes and speak to student organizations. It also fosters research and faculty development, assists the insurance industry in designing and delivering continuing education programs and helps educate the public about the insurance industry. Appalachian is designated a Global Center of Insurance Excellence by the International Insurance Society. Learn more at https://insurance.appstate.edu.