Walker College of Business alumnus Josh Ammons was recently featured in Insurance Business America magazine, the magazine for America's insurance brokering and advice community.

Ammons, who earned his degree in marketing from Appalachian State University in 2007, is senior vice president and property broker at AmWINS Group in Charlotte. AmWINS is the largest independent wholesale distributor dedicated to supporting retail brokers and solving their clients' specialty insurance needs.

Ammons also serves on the university's Brantley Risk & Insurance Center Board of Advisors, and in that capacity helps Walker College of Business students become strong candidates for jobs in the insurance industry.

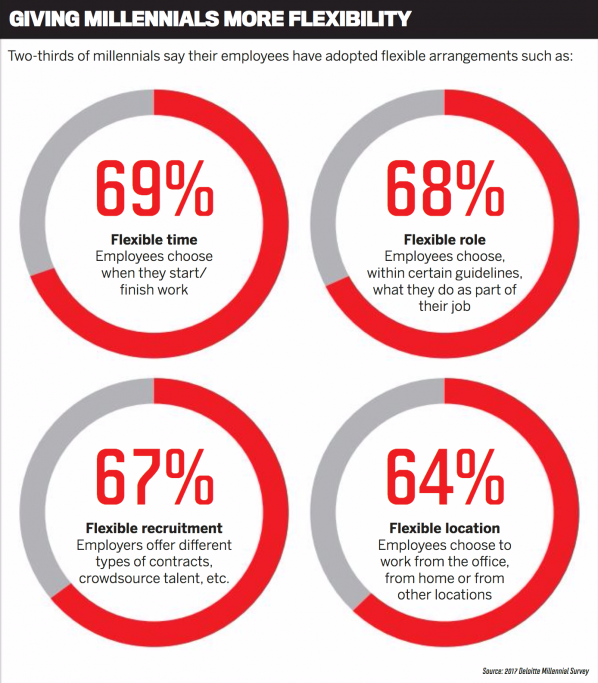

The article, The Next Generation of Leaders, begins on page 36 of Issue 5.07, details why it is critical for insurance companies to attract a young workforce.

In the middle of the last decade, [Josh Ammons] was a student at Appalachian State University on an academic scholarship, with no real interest or knowledge of the insurance industry, particularly the commercial side.

All that changed when Steve DeCarlo, the current CEO of AmWINS, served as a guest lecturer for Ammons' one and only insurance course, an introduction to risk management and insurance. DeCarlo spoke passionately about the insurance business - particularly the commercial side, with specific focus on excess & surplus lines - and the opportunities being created by the industry's growing talent gap. Ammons was impressed by what he heard.

"Ten minutes after he finished his speech, I sent Steve an email saying I loved his talk and that I thought I could be really successful in insurance," Ammons says."I was an arrogant 20-year-old, but he appreciated my email, and I ended up interviewing the next week and then interning with AmWINS that summer and winter. I've been with them ever since, coming up on 11 years."

Ammons now plays an active role in preparing younger millennials to enter the insurance industry. While serving as a guest lecturer, or representing AmWINS at the semi-annual RMI Career Fair or annual Business Connections event, Ammons can have an impact on the choices college students make.

When [Ammons] tells a room full of 20-year-old college students that the industry is a people business and is all about relationships, they begin to get engaged.

"Once they hear about the travel, the client outings and that there is no ceiling on earnings if you are constantly bringing value to your clients, they are ready to learn much more about what we do," Ammons says. "I'm also able to talk with them about the complexity of the deals we handle in the commercial and E&S spaces. I let them know it's not just homeowner's and auto insurance, like I thought when I was in their shoes more than 10 years ago."

According to data provided by Appalachian's BB&T Student Leadership Center, 12% of 2015-16 Walker College of Business graduates reported working in the insurance industry, and 98% of insurance graduates reported being at their first destination* by at least six months after graduation.

"We value input from our network and aim to continue growing in our engagement with our alumni base and our industry partners," said Walker College Dean Heather Norris. "One critical way we interact is through a very active network of eight college advisory boards, each providing invaluable perspectives."

The Walker College of Business is piloting WCOB Connect, a system intended to facilitate interaction opportunities between alumni and industry partners and the business leaders of tomorrow studying at Appalachian today. Submit your information at business.appstate.edu.

To make an immediate impact on a Walker College program through a financial contribution, contact Walker College Development Director Will Sears, searswill@appstate.edu.

* First destination statistics report employment rates, salaries and additional information regarding undergraduates six months post-graduation.

About the Brantley Risk & Insurance Center

Appalachian's Risk Management and Insurance Program is the seventh largest in the country. The college's Brantley Risk and Insurance Center, founded in 1988 with support from the Independent Insurance Agents of North Carolina, supports research and faculty development, assists the insurance industry in the design and delivery of training and continuing education programs, and facilitates interaction between students, faculty and the professionals in the insurance industry. Appalachian is designated a Global Center of Insurance Excellence by the International Insurance Society. For more information about the center, visit insurance.appstate.edu.